Salesforce Unveils Agentforce to Boost Financial Services Support

Introduction

In a significant move to enhance customer support and operational efficiency in the financial services sector, Salesforce has unveiled Agentforce, a cutting-edge solution designed to empower financial advisors, agents, and customer service representatives with AI-driven tools. This announcement marks a pivotal moment in the digital transformation of financial services, where personalized, efficient, and secure customer interactions are more critical than ever.

This blog post provides an in-depth exploration of Agentforce, covering its key features, benefits, industry implications, and future potential. By the end, you’ll have a thorough understanding of how this innovation is set to reshape financial services support.

Table of Contents

1. Understanding Agentforce: What Is It?

AgentForce is a next-generation customer relationship management (CRM) platform tailored specifically for financial services. Built on Salesforce’s industry-leading cloud infrastructure, it integrates artificial intelligence (AI), automation, and data analytics to streamline workflows, improve decision-making, and enhance client interactions.

Key Components of Agentforce

- AI-Powered Insights: Leverages Salesforce Einstein AI to provide real-time recommendations and predictive analytics.

- Unified Client View: Consolidates client data from multiple sources into a single dashboard.

- Automated Workflows: Reduces manual tasks with intelligent automation.

- Compliance & Security: Ensures adherence to financial regulations with built-in governance tools.

- Omnichannel Engagement: Supports seamless interactions across email, chat, phone, and in-person meetings.

2. Why Financial Services Needs Agentforce

The financial services industry faces unique challenges, including strict compliance requirements, high customer expectations, and increasing competition from fintech disruptors. Agentforce addresses these pain points by

A. Customer Experience

- Personalized Financial Advice: AI-driven insights help advisors tailor recommendations.

- Faster Response Times: Automation reduces delays in client communications.

- Proactive Support: Predictive analytics identify client needs before they arise.

B. Improving Operational Efficiency

- Reducing Administrative Burden: Automates routine tasks like scheduling and data entry.

- Streamlining Compliance: Built-in tools ensure regulatory adherence without extra effort.

- Enabling Remote Work: Cloud-based access allows agents to work from anywhere.

C. Boosting Sales & Retention

- Smart Lead Scoring: Prioritizes high-value prospects.

- Automated Follow-Ups: Ensures no client is left unattended.

- Cross-Selling Opportunities: AI suggests relevant financial products based on client behavior.

3. Key Features of Agentforce

Agentforce is packed with features designed to transform financial services operations. Here’s a closer look:

A. AI-Driven Financial Insights

Salesforce Einstein AI analyzes client data to provide:

- Personalized investment recommendations

- Risk assessment predictions

- Spending pattern insights

B. Unified Client Profiles

- Aggregates data from bank accounts, investment portfolios, and past interactions.

- Provides a 360-degree view of each client for better advisory services.

C. Automated Compliance & Reporting

- Real-time monitoring for suspicious activities.

- Automated audit logs for regulatory compliance (e.g., GDPR, FINRA, SEC).

- Document management for easy retrieval during audits.

D. Intelligent Workflow Automation

- Auto-schedules meetings based on client availability.

- Generates compliance-ready reports in seconds.

- Triggers alerts for policy renewals or portfolio rebalancing.

E. Seamless Omnichannel Support

- Clients can switch between chat, email, phone, and video calls without losing context.

- Integrates with WhatsApp, Slack, and Microsoft Teams for flexible communication.

4. Benefits for Different Financial Sectors

AgentForce is versatile, catering to various financial services segments:

A. Banking

- Personalized loan & mortgage recommendations

- Fraud detection alerts

- Automated customer onboarding

B. Wealth Management

- AI-powered portfolio optimization

- Automated rebalancing suggestions

- Client risk profile analysis

C. Insurance

- Claims processing automation

- Policy renewal reminders

- AI-driven underwriting support

D. Fintech & Neobanks

- Seamless API integrations

- Enhanced digital customer engagement

- Scalable CRM for hyper-growth

5. How Agentforce Compares to Traditional CRM Solutions

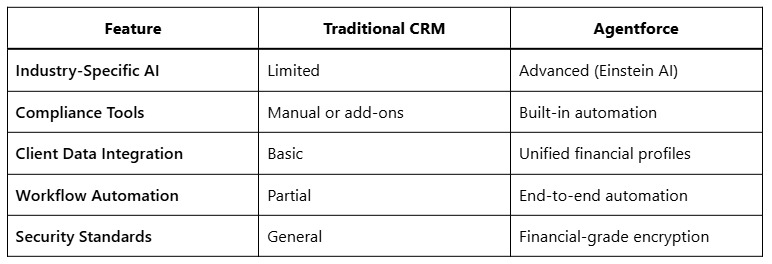

Unlike generic CRMs, Agentforce is built exclusively for financial services, offering

6. Real-World Use Cases

Case Study 1: A Major Bank Enhances Customer Retention

A global bank implemented Agentforce and saw:

- 30% faster response times

- 20% increase in client retention

- 50% reduction in compliance-related errors

Case Study 2: A Wealth Management Firm Boosts Advisor Productivity

By using AI-driven insights:

- Advisors saved 10+ hours per week on manual tasks.

- Client satisfaction scores rose by 25%.

7. The Future of Agentforce

Salesforce plans to expand Agentforce with:

- Blockchain integration for secure transactions.

- Enhanced voice assistants for hands-free advisory.

- Deeper ESG (environmental, social, governance) analytics for sustainable investing.

8. Challenges & Considerations

While Agentforce is revolutionary, firms must consider

- Data privacy concerns (ensuring client consent).

- Training requirements for staff adoption.

- Integration costs with legacy systems.

9. My Takeaway: Salesforce Unveils Agentforce

AgentForce represents a quantum leap in financial services CRM. By combining AI, automation, and compliance, it empowers firms to deliver faster, smarter, and more secure client experiences. As digital transformation accelerates, adopting solutions like Agentforce will be crucial for staying competitive.

Financial institutions that embrace this innovation early will gain a significant edge in customer satisfaction, operational efficiency, and regulatory compliance. The future of financial services support is here and it’s called Agentforce.