Salesforce Stock Slips as Investors Worry Over AI Monetization Pace

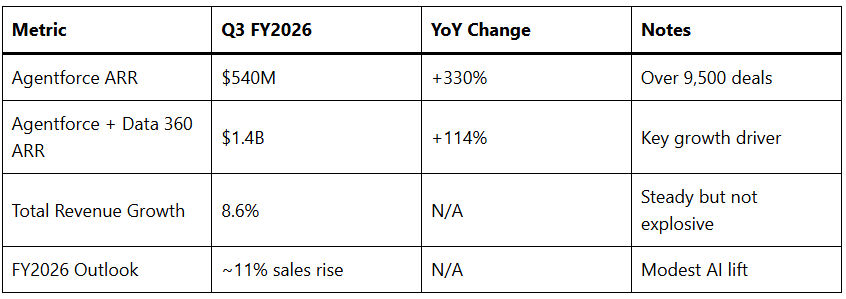

Salesforce’s stock has faced significant pressure in early 2026 due to investor skepticism about the pace of AI revenue generation from initiatives like Agentforce. While the company reports strong adoption metrics, such as over 9,500 paid Agentforce deals and $540 million in recurring revenue (up 330% year-over-year), Wall Street worries that these gains aren’t translating into accelerated overall growth fast enough. This disconnect has led to sharp declines, including a 7% single-day drop in January amid sector-wide AI doubts and macroeconomic headwinds.

Table of Contents

Event Timeline

Salesforce shares plunged nearly 7% on January 13, 2026, the steepest decline since May 2024, triggered by Adobe’s downgrade and skepticism over Salesforce’s Slackbot AI agent launch. Earlier, in late February 2025, the stock fell 5% after fiscal 2026 guidance indicated only a “modest” Agentforce revenue impact that year. By mid-February 2026, year-to-date losses exceeded 30%, mirroring a broader software sector pullback on AI overhype fears.

Core Investor Concerns

Investors doubt AI’s ability to lift Salesforce beyond 9-10% annual revenue growth, viewing Agentforce as maintenance spending rather than a new revenue engine. Pricing models shift to seat-based and usage fees, but analysts like Gartner warn of future “cost shocks” as unlimited deals end. Macro factors, including stubborn inflation, higher rates, and data center cost debates under President Trump, amplify risks for high-valuation cloud stocks.

Salesforce AI Strategy

Agentforce, central to the “Agentic Enterprise” vision, automates tasks across sales, service, and marketing, backed by Data Cloud for unified insights. Q3 FY2026 saw Agentforce and Data 360 hit $1.4 billion ARR (114% YoY growth), with 3.2 trillion tokens processed. CEO Marc Benioff touts 3-10x value from AI investments, including acquisitions like Informatica for data unification, but admits substantial revenue ramps into 2026-2027.

Financial Snapshot

Analyst Perspectives

Wall Street mixed: some see buy opportunity post-30% drop, citing improving margins (33%) and AI momentum. Others flag lagging adoption amid economic caution, with Forrester predicting AI spending delays to 2027. Starboard Value remains optimistic despite underperformance versus Magnificent Seven.

Broader Market Context

Software stocks broadly derate in 2026, with fears that AI commoditizes CRM like ChatGPT threats. Salesforce lags Dow peers, down 10% YTD by mid-January, despite Benioff’s Trump ties. Positive: Agentforce boosts multi-cloud deals, with top contracts tied to AI transformation.

Future Outlook: Salesforce Stock Slips

Salesforce eyes “substantial” Agentforce impact in late 2026, focusing on governance, cross-cloud automation, and enterprise AI. Success hinges on proving ROI amid pricing scrutiny and macro risks; rebound possible if Q4 bookings accelerate. For CRM pros, this underscores piloting Agentforce now for 2027 scalability.