Salesforce in France: 2025-26 CRM Strategy and Job Market

Introduction: Salesforce in France

As the global leader in Customer Relationship Management (CRM) solutions, Salesforce continues to strengthen its presence in France, a key European market undergoing rapid digital transformation. With French businesses increasingly prioritizing AI-driven automation, hyper-personalized customer experiences, and cloud-based solutions, Salesforce is well-positioned to dominate the CRM landscape in 2025-26.

Table of Contents

1. Salesforce 2025-26 Strategic Focus in France

1.1 AI and Hyperautomation with Einstein AI

Salesforce Einstein AI is becoming the backbone of intelligent CRM in France, enabling:

- Predictive sales forecasting – AI analyzes historical data to predict deal closures and revenue trends.

- Automated customer service – Chatbots and virtual agents handle 60-70% of routine inquiries, reducing operational costs.

- Personalized marketing – AI-driven recommendations in Marketing Cloud boost engagement by 30-40%.

Industry Impact:

- Retail: Dynamic pricing and product recommendations

- Banking: Fraud detection and personalized financial advice

- Healthcare: Patient engagement and appointment scheduling

1.2 Industry-Specific Cloud Solutions

Salesforce is doubling down on verticalized offerings for French enterprises:

1.3 Sustainability and Ethical CRM

France’s strict ESG (Environmental, Social, and Governance) regulations are pushing Salesforce to innovate in:

- Carbon footprint tracking – Embedded analytics in Supply Chain Cloud

- Green CRM initiatives – Eco-friendly data centers in compliance with EU laws

- Ethical AI – Transparent algorithms to avoid bias in customer interactions

1.4 Hybrid Work and Collaboration Tools

With 40% of French companies adopting hybrid work models, demand is surging for:

- Salesforce Anywhere – Real-time collaboration for remote teams

- Slack integrations – Seamless communication between sales, service, and IT

- Quip for document management – AI-powered document automation

1.5 Data Sovereignty and Compliance

Due to France’s strict data laws (GDPR, CNIL), Salesforce is:

- Expanding local data centers (e.g., AWS Paris Region)

- Enhancing encryption and access controls

- Offering GDPR-compliant analytics in Tableau CRM

2. CRM Adoption Trends in France (2025-26)

2.1 Mid-Market and SMB Adoption Accelerates

While large enterprises already use Salesforce, small and medium businesses (SMBs) are now adopting:

- Sales Cloud (€25-50/user/month) – Pipeline management, lead scoring

- Service Cloud – Omnichannel customer support

- Pardot (B2B Marketing Automation) – Lead nurturing for tech startups

Case Study: A French e-commerce startup increased conversions by 25% using Salesforce’s AI-powered recommendations.

2.2 Hyper-Personalization Becomes Standard

French consumers expect tailored interactions, driving demand for:

- 1:1 customer journey mapping – AI predicts next-best actions

- Dynamic content in Marketing Cloud – Real-time email personalization

- Social CRM integrations – LinkedIn Sales Navigator, WhatsApp Business

2.3 Integration with France’s Tech Ecosystem

Salesforce is deepening partnerships with:

- French SaaS leaders (e.g., Algolia, Aircall)

- Government digital programs (France 2030, La French Tech)

- System Integrators (Capgemini, Accenture) for large-scale deployments

2.4 Low-Code/No-Code Democratizes CRM

Business users (non-developers) are building apps with:

- Salesforce Lightning Platform – Drag-and-drop app builder

- MuleSoft Composer – API integrations without coding

- Flow Orchestrator – Automated approval workflows

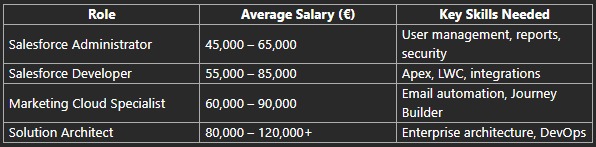

3. Salesforce Job Market Outlook in France

3.1 Talent Shortage Drives High Salaries

France faces a 20-30% skills gap in Salesforce talent, leading to lucrative roles:

Top Paying Industries:

- Banking (BNP Paribas, Société Générale)

- Luxury (LVMH, Kering)

- Telecom (Orange, Bouygues Telecom)

3.2 Most In-Demand Certifications

Professionals are upskilling with:

- Certified Administrator (Entry-level)

- Platform Developer I/II (Coding focus)

- Marketing Cloud Consultant (Digital Marketing)

- Data Architect (Advanced Analytics)

Training Providers:

- Trailhead (Free) – Salesforce’s official learning platform

- Udemy/Coursera – Affordable certification prep

- Local Bootcamps – Le Wagon, Simplon (French-language courses)

3.3 Remote Work Expands Opportunities

- 30% of Salesforce jobs are now fully remote.

- Companies hire across France (Paris, Lyon, and Toulouse hubs).

- Freelance Salesforce consultants earn €70-150/hour.

4. Challenges for Salesforce in France

4.1 Talent Gap and Training Bottlenecks

- Lack of French-language training – Most resources are English-dominant

- University programs lag behind – Few formal degrees in Salesforce

4.2 Competition from European CRMs

- SAP (Germany) – Strong in enterprise ERP integrations

- Odoo (Belgium) – Popular among SMBs for affordability

- Local players (e.g., Sellsy, Dolibarr) – Niche industry focus

4.3 Data Localization Pressures

- CNIL regulations require French customer data to stay in-country.

- Cloud Act concerns – U.S. laws may conflict with EU privacy rules

5. Conclusion:

As France accelerates its digital transformation, Salesforce remains at the forefront of CRM innovation. The 2025-26 period will see increased adoption of AI-powered tools like Einstein AI, industry-specific cloud solutions, and compliance-focused features to meet French data regulations. The job market for Salesforce professionals will continue thriving, with high demand for administrators, developers, and marketing specialists. Businesses embracing these trends will gain a competitive edge through enhanced customer experiences and operational efficiency.