Salesforce Bets on Informatica: Can It Coexist with MuleSoft?

Introduction: Salesforce Bets on Informatica

The recent news of Salesforce exploring a potential acquisition or strategic partnership with Informatica has sent ripples across the enterprise software landscape. As two of the biggest players in data integration and cloud computing, a collaboration between Salesforce and Informatica could reshape how businesses manage, integrate, and leverage their data.

Table of Contents

1. Why Is Salesforce Interested in Informatica?

a) The Data Integration and Cloud Boom

With enterprises increasingly moving to the cloud, the demand for seamless data integration, ETL (Extract, Transform, Load), and data governance has skyrocketed. Salesforce, as a leader in CRM and cloud applications, understands that data is the lifeblood of modern business.

Informatica, a pioneer in enterprise data management, offers:

- Cloud Data Integration (CDI) & Intelligent Data Management Cloud (IDMC): A unified platform for data integration, quality, and governance.

- AI-powered data cataloging & metadata management: Helps enterprises discover and manage data assets efficiently.

- Strong hybrid and multi-cloud capabilities: Unlike pure-play SaaS vendors, Informatica supports complex on-premises-to-cloud migrations.

b) Complementing MuleSoft’s API-Led Approach

MuleSoft, acquired by Salesforce in 2025 for $6.5 billion, excels at API-led connectivity, enabling seamless integration between applications. However, MuleSoft’s core strength lies in real-time application integration rather than large-scale data warehousing, ETL, and master data management (MDM) areas where Informatica dominates.

By acquiring Informatica, Salesforce could:

- Expand its data integration portfolio beyond APIs into batch processing, ETL, and data quality.

- Strengthen its position against Microsoft (Azure Data Factory) and Snowflake, which are making strides in enterprise data ecosystems.

- Offer end-to-end data solutions from real-time app integration (MuleSoft) to batch data processing (Informatica).

c) Competitive Pressure from Hyperscalers

Microsoft (Power Platform + Azure Data Factory), Google (BigQuery + Dataplex), and AWS (Glue + AppFlow) are embedding data integration into their cloud stacks. Salesforce risks falling behind if it doesn’t bolster its data capabilities beyond CRM.

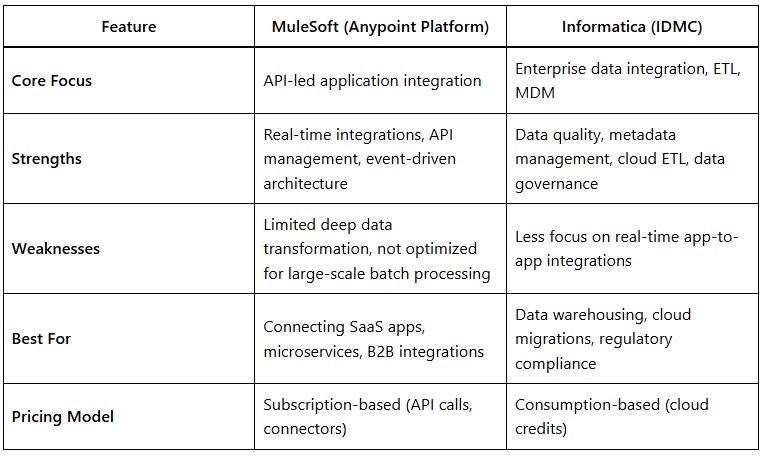

2. MuleSoft vs. Informatica: Strengths and Weaknesses

Key Takeaways:

- MuleSoft is the go-to for real-time API integrations (e.g., connecting Salesforce to SAP, Workday, or legacy systems).

- Informatica excels in bulk data processing (e.g., migrating an on-premises data lake to Snowflake or enforcing GDPR compliance).

3. Can They Coexist, or Will Salesforce Consolidate?

a) Scenario 1: Coexistence with Clear Differentiation

Salesforce could position:

- MuleSoft for application and API integration (e.g., CRM, ERP, SaaS apps).

- Informatica for enterprise data management (ETL, MDM, data quality).

Pros:

- Customers get best-of-breed solutions for different use cases.

- No immediate disruption for existing users.

Cons:

- Overlapping capabilities in areas like cloud data integration could confuse buyers.

- Sales and marketing teams may struggle to position both platforms distinctly.

b) Scenario 2: Forced Consolidation (Long-Term Risk)

Salesforce might eventually merge the platforms, creating a unified “Salesforce Data Cloud+” combining MuleSoft’s APIs and Informatica’s ETL.

Pros:

- A single platform for all integration needs.

- Reduced licensing complexity.

Cons:

- Technical challenges in merging two different architectures (event-driven vs. batch processing).

- Potential backlash from customers who prefer best-of-breed solutions.

c) Scenario 3: Salesforce Phases Out One Platform

If overlap becomes unsustainable, Salesforce may sunset parts of MuleSoft (e.g., legacy ETL functions) or Informatica (redundant cloud connectors) over time.

Risk: Alienating existing customers who invested heavily in one platform.

4. What Does This Mean for Customers?

a) Short-Term Implications

- More choices, but potential confusion: Will Salesforce push MuleSoft for app integration and Informatica for data pipelines?

- Pricing & licensing changes: Bundled offerings may emerge, but costs could rise if Salesforce adopts premium pricing.

b) Long-Term Considerations

- Vendor lock-in risk: If Salesforce dominates both API and data integration, switching costs increase.

- Innovation vs. stagnation: Will competition drive better features, or will Salesforce slow down development to force consolidation?

5. Competitive Landscape: Who Wins and Loses?

1. Winners:

- Salesforce (if integration succeeds, it becomes a one-stop shop for data and apps).

- Customers (if they get a seamless, unified experience).

2. Losers:

- Standalone ETL vendors (Talend, Boomi) may struggle to compete.

- Hyperscalers (Microsoft, AWS) face a stronger Salesforce data ecosystem.

My Takeaway:

Salesforce’s potential bet on Informatica signals its ambition to dominate not just CRM but the entire enterprise data stack. While MuleSoft and Informatica can coexist in the short term, long-term consolidation seems inevitable.

The coming months will reveal whether Salesforce can successfully balance both platforms or if it will reshape the data integration landscape forever.

What’s your take? Should Salesforce keep them separate or merge MuleSoft and Informatica? Let’s discuss in the comments!