Ecosystem Response to Salesforce New Agentforce Pricing Revealed

Introduction

Salesforce, a global leader in customer relationship management (CRM) software, has recently introduced a new pricing model for its Service Cloud Agentforce product. This change has sent ripples across the ecosystem, affecting customers, partners, and competitors alike. The new pricing structure aims to streamline licensing costs but has also sparked debates about affordability, accessibility, and long-term value for businesses relying on Salesforce’s customer service solutions.

Table of Contents

1. What is Salesforce Agentforce?

Agentforce is a component of Salesforce Service Cloud, designed specifically for customer service agents. It provides tools for case management, omnichannel support (email, chat, phone), AI-powered recommendations, and workflow automation. Traditionally, Salesforce has offered Agentforce as part of its Service Cloud licensing, but with varying tiers based on features and scalability.

The product is widely used across industries, including

- Financial Services (banks, insurance)

- Healthcare (patient support)

- Retail & E-commerce (customer inquiries)

- Telecommunications (help desks)

With the new pricing model, Salesforce is restructuring how businesses pay for Agentforce, impacting both existing and potential customers.

2. Key Changes in the New Pricing Model

Salesforce updated Agentforce pricing introduces several major shifts:

A. Tiered Pricing Based on Feature Access

- Essential Tier: Basic case management, email support (lower cost, fewer features).

- Advanced Tier: Adds live chat, AI-driven insights, and workflow automation.

- Premium Tier: Full omnichannel support, advanced analytics, and premium integrations.

B. Per-Agent vs. Bulk Licensing

- Previously, companies could negotiate enterprise-wide deals.

- Now, pricing is more standardized per agent, making it costlier for large teams.

C. Reduced Discount Flexibility

- Salesforce partners previously had more leeway in offering discounts.

- The new model enforces stricter pricing controls, reducing negotiation power.

D. Bundled vs. À La Carte Features

- Some previously standalone features (e.g., Einstein AI) are now bundled, forcing customers into higher tiers.

E. Increased Costs for High-Volume Support Teams

- Businesses with large agent teams (e.g., call centers) may see 20-30% cost increases.

3. Immediate Reactions from the Ecosystem

A. Customer Reactions: SMBs vs. Enterprises

1. Small & Medium Businesses (SMBs):

- Many SMBs are frustrated, as the per-agent pricing makes scaling expensive.

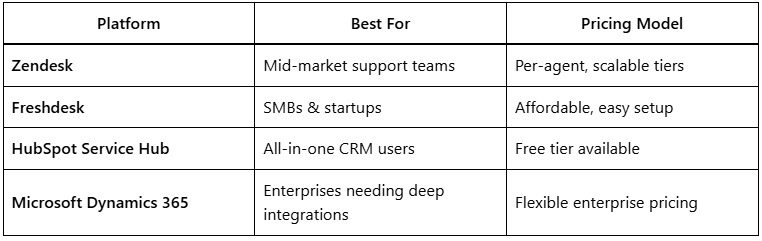

- Some are exploring alternatives like Zendesk, Freshdesk, or HubSpot Service Hub.

2. Enterprises:

- Larger companies with existing contracts are less affected but wary of future renewals.

- Some enterprises are pushing back, demanding custom pricing exceptions.

B. Salesforce Partners & Consultants

1. Implementation Partners:

- Concerned about losing deals due to higher costs.

- Adjusting sales strategies to focus on higher-tier plans.

2. ISVs (Independent Software Vendors):

- Some ISVs building on Salesforce may need to repackage integrations.

C. Competitors’ Responses

- Zendesk & Freshworks:

- Offering migration incentives for unhappy Salesforce customers.

- Microsoft Dynamics 365:

- Highlighting their flexible pricing as a key differentiator.

- HubSpot:

- Promoting its all-in-one CRM as a cost-effective alternative.

4. Pros and Cons of the New Pricing Strategy

Pros:

✅ Simplified Pricing Structure – Easier to understand for new customers.

✅ Better Feature Alignment – Ensures users pay only for what they need.

✅ Encourages AI Adoption – Bundling Einstein AI could drive automation.

Cons:

❌ Higher Costs for Scaling Teams – Per-agent pricing hurts high-volume businesses.

❌ Reduced Discount Flexibility – Harder for partners to offer competitive deals.

❌ Risk of Customer Churn – Competitors are aggressively targeting dissatisfied users.

5. Long-Term Implications for the CRM Market

1. Salesforce’s Market Position:

- If customers accept the changes, Salesforce retains dominance.

- If backlash continues, competitors could gain market share.

2. Shift Toward Alternative Pricing Models:

- More vendors may adopt usage-based pricing (e.g., pay per ticket resolved).

3. Consolidation in the CRM Space:

- Smaller players may merge to compete with Salesforce’s bundled offerings.

6. Alternatives for Businesses Considering a Switch

For companies re-evaluating their CRM due to the new pricing, here are some options:

7. My Takeaway: Salesforce New Agentforce Pricing

Salesforce new Agentforce pricing model, centered around Flex Credits and Flex Agreements, has sparked a mixed response across the ecosystem. While many applaud the move for aligning costs with usage and adding flexibility, others express concerns over complexity and budgeting challenges. Overall, this pricing shift signals Salesforce’s growing commitment to AI-driven automation and adaptable solutions. As businesses adjust to this change, understanding the value and tracking usage will be key to maximizing ROI under the new Agentforce pricing framework.